CRED App Review : Want a new phone, television, Air condition, or even an exotic vacation to the Maldives? You just name it and your credit cards would do the rest. Well, it is 2022 and who doesn’t use credit cards for paying off their bills? The answer is yes, we all do.

But, wait what if I tell you there is an app known as CRED that rewards you every time you pay your bills through it. Exciting right? Yes, CRED is the next-gen app that helps you to store all the details of your credit cards with different billing cycles and prompt you for paying bills on time.

So, let us dive deep to explore the CRED app and its related risks, offers, and some tips for users to benefit from the app on regular basis with our In-depth CRED App Review.

CRED App Review : What is CRED App & How Does It Work?

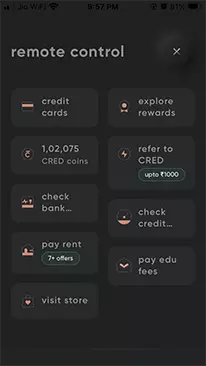

You can download the CRED app from the play store, and install it like any other app on your phone, after the installation it fetches your basic details from your email and asks for bank details to sync your credit cards with the app.

Now, every time the date of your billing cycle comes it prompts you for the payment and once it receives the payment from you through UPI or net banking, it pays to your credit card company or the bank from which it is issued.

Also Check: Best Rechargeable Battery Chargers In India For 2022

The payment usually takes from 24 to 48 hours and a confirmation message is sent to your registered mobile number through CRED and through your credit card issuer. The process repeats for all the other credit cards as well, so it is a hassle-free way to manage all your credit cards in one place and avoid facing any penalties in the future for late fees.

Well, that’s it you are done!

Oh no wait, there is more to it. Yes, what about the rewards and offers which we discussed earlier? For that let us first understand the reward system of the CRED application in detail.

Reward System of CRED App

The two ways in which CRED rewards you:

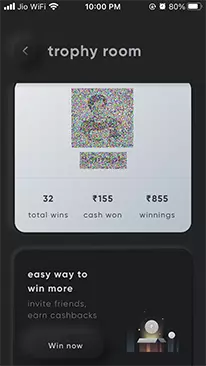

- Points: The points are gained after each payment and one-point equals to one rupee.

- Gems: The gems are obtained on each referral and one-referral equals to 10 gems.

Apart from using these points for paying bills with their ‘kill the bill’ feature, you can also accumulate these points and can redeem them in the form of discount vouchers of reputed brands both online and offline, in this way you can get your hands on some freebies from the app.

Important CRED App Offers

Redeem Your CRED Points For Cash (Kill The Bill)

The CRED app gives you an opportunity to redeem your points for the actual cash, here is a table that explains to what extent you can get a cashback for your accumulated points.

| Number of Points Burned | Maximum Cashback |

| 1,000 | Up to Rs 1000 |

| 5,000 | Up to Rs 10,000 |

| 15,000 | Up to Rs 50,000 |

| 30,000 | Up to Rs 1,00,000 |

Redeem Your CRED Points For Various Offers

The amount of offers you get on CRED is the USP for the app, as it provides unlimited discount offers in different categories such as food, clothing, travel, beauty products, and what not? You can avail of huge discounts by redeeming your points against these offers and to be honest, it is more beneficial to use these points for the offers rather than going for the actual cash.

Bookmyshow, Big basket, Ixigo, Raymond, GAP, Diesel denim are a few of the companies that offer CRED points redeemable options with regular offer updates on the app.

Also Read:UC Browser Review : Is UC Browser Safe? Risks, Solution

Redeem CRED Gems

You can gather these gems by referring the app to other people via a shareable link on different social media. For each referral, you attain Rs. 150 worth of CRED gems.

These gems can further be redeemed for either the cashback or against some exiting offers available on the app.

Benefits of Using CRED

Apart from the rewards and offers what other important benefits or features are there of using CRED? Well, there is something more to it that makes it a different and revolutionary app in the field of finance.

Rent Payment With CRED

This feature allows you to pay your monthly rent on a timely basis through the app with an additional feature to schedule the rent payment that will send an alert message to remind you of the due rent, however, a fee of 1.5% is charged as a service charge on each payment.

Get Instant Loan Using CRED Stash

You can avail of a non-secured loan up to INR 5 lakh on the app using a feature known as Stash on the app. Of course, the interest rates depend on the creditworthiness of the borrower although 12.5% per annum is the median rate of interest charged on the app.

The loan amount is credited in your bank account with 48 to 72 hours of applying for the loan.

You Would Also like:Musicolet Review : Best Replacement for your Default Music Player

Check Your Credit Card Score on CRED App

A credit card score tells the banks and NBFCs about your creditworthiness, the higher the credit score the higher the trust level.

However, the app does not provide the credit scores from CIBIL but from American companies like Experian and CRIF only.

Expense Tracker On CRED

CRED gives you an option to track your expenses and analyse your spending behaviour. You can customize and make different expense heads and cap the amount you want to spend on each expense head.

In this way, you can make a budget and limit your expenses over a period of time. However, it does not track the expenses made by other payment modes such as cash, net banking, etc.

Security Tracker Feature Of CRED APP

This is probably the most important feature of this app, it keeps track of your daily usage and allows you to limit the number of transactions for the day and even the amount for that matter.

The application sends you an immediate alert for any suspicious or over-the-budget transaction and allows you to contact your credit card issuer for the revocation in an unfortunate event such as theft.

Also Check: Sony WF-C500 Review : The Perfect Companion

Is CRED App Safe?

With the usage of an increasing number of applications especially the apps related to money and finance, there lies a constant threat to our data. In this CRED App Review we would like to talk about this topic a bit as well.

So, data privacy is the utmost important factor when it comes to apps just like CRED that uses our bank account details for simplifying the transaction process. We are constantly at the risk of a data breach or a system hack that could potentially lead to our data leakage.

However, the company assures you of no such mishaps but, we have seen a lot of online frauds in the recent past and there is no such app or website which is fully prone to hacking.

All said and done, But, what is more annoying is that you cannot unlink your credit cards once you linked them with CRED which is very irritating and suspicious.

Also, This app requires full access to your Email id, bank, and credit card statements to provide you a good user experience and seamless payment of your credit card bills, but at what cost is still a big question left unanswered.

CRED App Review : The Conclusion

We have listed all the features of the app along with its benefits and privacy issues in a detailed manner in this review, so now the ball is in your court and you have to decide whether to go for the app or not.

However, if you talk about our honest verdict!

If you are a type of person who uses a single credit card with limited expenditure then you can simply avoid and rather use other platforms such as Paytm, Phonepe, etc, that offer you almost the same features if not more.

On the other hand, if you have multiple credit cards with high expenditure and often find it difficult to manage your credit cards billing cycle then CRED is a one-stop solution for you, we would highly recommend you to use the CRED app and get great offers and discounts on the usage of your credit cards.

Published on:Mar 1, 2022 at 08:06